Popularly, gold is seen as a long-term investment for many, the gold prices in each state tend to change especially with the onset of elections, with 50 states showing different reactions to their views on gold. In a nutshell, different states show different investment behavior which is also dependent on different gold products.

There are many reasons why this change in behavior takes place, such as the historical pattern seen through the years and there has been change in the prices of gold during this period of time, particularly a rise in the price of gold is observed due to uncertainty.

Another reason being the economic policies very much depends on which party wins, Republican or Democrat.

An example from the Royal Mint would be during Donald Trump’s presidency, there was a US-China trade war and the Covid-19 pandemic that really caused the gold prices to skyrocket, this shows how multiple factors affect the gold prices including presidency.

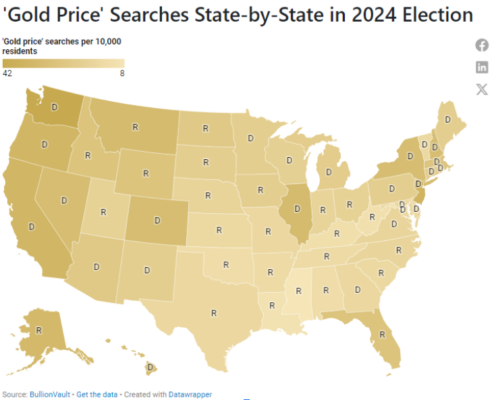

An article by BullionVault, helps put this into perspective by illustrating different states and their search habits when it comes to gold.

States with High Gold Price Searches

States such as Washington, New Jersey, Oregon, and California exhibit the highest gold price search activity under Democratic leadership. Despite having high GDPs, these states experience elevated unemployment rates, highlighting how political climates can influence investment behaviors.

States with Moderate Gold Prices

States like Alaska, Montana, New York, Illinois, and Idaho show moderate gold price searches. Interestingly, Nevada has the highest unemployment rate in the country but still records 31 searches per 10,000 residents, suggesting a moderate interest in gold showing a cautious approach to investment amid economic fluctuations.

States with Lower Gold Price Searches

In contrast, states such as Florida, South Dakota, Missouri, Louisiana, Mississippi, and West Virginia demonstrate lower gold price search activity, all under Republican leadership. These states also have lower unemployment rates, suggesting a moderate interest in gold showing a more calculated approach to investment due to economic fluctuations. The need for gold may be less due to needing less protective investment compared to states with higher unemployment and economic uncertainty.

Correlation of Gold Prices and Employment Rates

Research indicates that during economic downturns, unemployment rises, prompting more individuals to seek gold as a safe haven. This suggests a positive correlation between unemployment rates and interest in gold which might indicate why some states with higher unemployment rates would have more gold price searches when compared to states with higher employment rates.

Conclusion

Making calculated purchases based on economic conditions, political climates, and market trends can be helpful when it comes to gold investing but ultimately timing the market is almost impossible. This is where good long-term timeframes come into play when it comes to investing. If you are one of the many people across the United States searching for gold investing options, make sure you do your research beforehand to maximize your chances of success.