by Kevin Cody

Hermosa Beach housing laws, in 2023, were put through a blender of State mandated legislation, whose alphabet soup of acronyms, and ambitions rival those of the New Deal, where the term alphabet soup was introduced.

Whether chopped liver, or liver pate will be the result will depend on the public/private partnerships Hermosa’s city council is counting on to produce a new civic center, affordable housing (Hermosa currently has none), and new city revenue.

The council’s most ambitious 2023 plan is facilities study Option A, which calls for a new, $100 million City Hall, police station and library.

LVR (Land Value Recapture) is the most transformative 2023 council plan. If implemented, Pier Avenue, from Monterey Boulevard to Valley Drive, will be lined with previously prohibited residential development, as will swatches of Pacific Coast Highway and Aviation Boulevard.

LVR is driven by RHNA (Regional Housing Needs Allotment), a State mandate requiring Hermosa Beach to increase residential density by 558 new residences by 2029, reversing a half century of council efforts to reduce residential density.

The new residences must include 64 ADUs (Accessory Dwelling Units), of which 43 must be for moderate to very low income residents. (ADUs are residential units of not more than 850 sq. ft.)

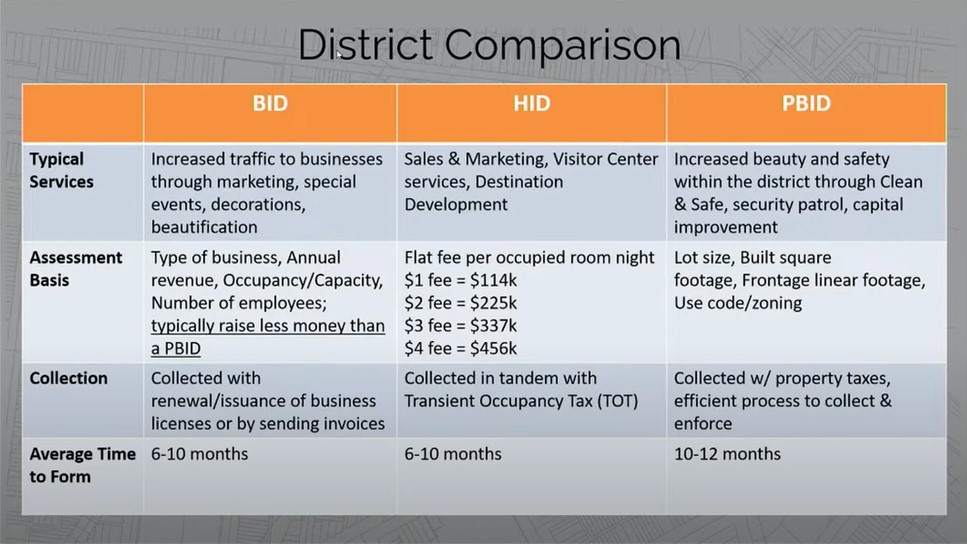

Also in 2023, the council approved funding for a downtown BID (Business Improvement District). BIDs tax their members to fund district marketing and capital improvements.

‘A’ stands for a new Civic Center

During 2023’s second to last council meeting, on Wednesday, November 29, the council unanimously agreed to advance plans for a new, $100 million civic center on the Community Theater parking lot.

The new civic center would be financed, in part, by the sale, or lease of the current civic center site, voter approved bonds, and personnel savings resulting from more efficient city facilities. AI was also mentioned as a potential cost savings source by Mayor Justin Massey during a council budget meeting in June.

“I believe in investing in our community, like our predecessors did,” Mayor Massey said during the November 29 special facilities council meeting. “The buildings we love, the places we love are here because someone had the vision and spent the money to make something future generations would enjoy.”

Massey pointed to the new Vista School built on the old North School site, and the Hermosa Valley and Hermosa View school renovations as examples. Voters approved a $59 million bond in 2016 to finance the school projects.

Despite the $100 million estimate for the new civic center, consultant Jeffrey Fullerton told the council, “If done right, I think this can have a positive contribution to the city’s budget, or at least be cost neutral.”

Groundbreaking could take place in two years, Fullerton said. City manager Suja Lowenthal said gathering community input could begin early next year.

“It should be obvious that all our facilities are failing,” Councilmember Jackson said. “It’s easy to keep putting a band-aid over what is a gushing, sucking chest wound. You come here any day when it’s raining and it’s embarrassing. You walk through the facilities and it’s embarrassing.”

All of the councilmembers expressed preference for leasing rather than selling city property to help finance a new civic center. They also stressed the importance of including the Historical Museum, the Friends of the Library room, and the skate park in a new civic center.

But there is a potential bone in the State’s alphabet soup. The SLA (Surplus Land Act) requires government agencies to invite proposals for affordable housing on surplus properties.

The affordable home business

Most of the retail and office buildings on Upper Pier Avenue in downtown Hermosa Beach date back to post World War II, and some to post World War I. Those buildings are targeted for new residential development under an LVR (Land Value Recapture) plan approved by the City Council during its last meeting in 2023, on December 12. The plan involves rezoning upper Pier and patches of commercial properties on Pacific Coast Highway and Aviation Boulevard for mixed use. Mixed use allows homes to be built on commercial properties.

The LVR plan includes fees set to encourage “affordable,” rather than market priced homes. The fees are waived if the new home prices are affordable for low or moderate income households.

As the acronym suggests, LVR fees are meant to “recapture” for the city a share of the profits from residential development, which is more profitable than commercial development.

“The primary intent of the LVR program is to incentivize development of affordable housing to meet the City’s RHNA (Regional Housing Needs Allocation) mandate. The second intent is to generate a local funding source to assist in new affordable units, and to benefit a regional Housing Trust,” Community Development Director Carrie Tai explained in a report to the council.

Affordable housing built in the mixed use zones will be subject to a deed restriction requiring the rent to remain affordable for moderate to very low income households for 55 years.

Additionally, affordable housing in the mixed use zones may only be resold at affordable home prices. Appreciation will be split evenly between the property owner and the city, Community Development Director Carrie Tai said.

Opponents of the LVR fees and restrictions expressed fears the high fees will discourage new development of both affordable and market rate housing.

LVR funds do not go into the city’s general fund.

But the mixed use zoning could lead to new sales tax revenue, according to Larry Kosmont, the city’s LVR consultant.

“One can argue that the retail that is left cannot survive without residential rooftops nearby. The key is to capture local ‘spend’ because in today’s reordered universe, ‘spend’ wants to be local,” Kosmont said in a 2022 interview with The Planning Report.

Crossing paths with St. Cross

Saint Cross Episcopal Church indicated to the city a willingness to develop affordable housing on the 14 lots it owns along Monterey Boulevard. The council responded by proposing to rezone the church property as high density residential, or R-3. The new zoning would contribute 66 units to the city’s RHNA inventory, where only nine currently exist.

Neighbors, calling themselves Preserve Our Neighborhood, presented a 2500 signature petition opposing the upzoning to the council at its July 11 meeting.

St. Cross neighbor Todd Mackey told the council, “If you pass the housing elements as is, including the St. Cross property, your legacy for this city that we all love, will be to have significantly, irrevocably and eternally damaged the high quality live-ability and appropriate development of this city. It’s on you,” he said.

The council agreed to reduce the allowable number of residential units on the St. Cross properties to approximately 25.

Much ADU about price

ADU (Accessory Dwell Unit) is another RHNA-driven program to encourage affordable housing, statewide. An ADU is an attached or detached residential unit of not more than 850 sq. ft. with a kitchen and bathroom, located on the lot of an existing, primary residence.

Hermosa Beach has been mandated by the State to approve 64 ADUs by 2029. Of these, 11 must be for very low-income residents, 28 for low income residents and four for moderate-income residents. But neither the state nor the city can dictate the price of ADUs.

“Put yourself in the place of a property owner,” Hermosa Beach Planning Commissioner Peter Hoffman said. “If you’re building a $5 million home and you have the opportunity to build an ADU, aren’t you going to build it to luxury standards? You’re not going to be building inexpensive ADUs in Hermosa.”

Realtor Jonathan Coleman, who specializes in Hermosa Beach properties, said even market priced ADUs may help slow the “cascading effect” of rising prices, which force Hermosa residents to move to communities with lower prices.

BID for downtown betterment

In January 2023, the City Council approved $5,000 to retain a consultant to study formation of a downtown BID (Business Improvement District). BIDs tax district business, and/or property owners to fund district marketing and capital improvements.

“We’ve been talking about this for about 500 years,” quipped Ed Hart, owner of Maximus Salon, and one of the dozen business owners who attended a BID meeting at City Hall in May.

Ralph Russomano, of Hennessey’s Taverns, and treasurer of the Riviera Village BID, noted that the Riviera BID often partners with the City of Redondo Beach on projects such as new planters. He said the Riviera Village BID’s budget of $110,000 annually comes from city business licenses; and events organized by the BID, such as the farmers market, and the annual Riviera Village festival. Redondo’s Riviera Village BID dates back to 2003.

Manhattan Beach has a North Manhattan BID, and a downtown BID. The downtown BID is a non-profit, and not subject to the Manhattan City Council. The North Manhattan Beach BID is subject to the city council.

Hermosa City Manager Suja Lowenthal said in a statement to Easy Reader in February that a downtown Hermosa BID board and expenditures would be subject to city council approval.

Once a BID is formed, businesses within the district are assessed, whether or not the business owner, and/or property owner supported the BID formation. ER