by Mark McDermott

The Manhattan Beach City Council Tuesday night unanimously approved going forward with a ballot measure in the November election that would increase the local sales tax by a half cent. If approved by voters, the increase would generate $5 million in annual revenues for the City.

Councilperson Steve Napolitano, who brought the matter forward for council consideration, said existing revenues are not enough to meet the City’s needs.

“Everybody hates taxes. Everyone wants to pay less in taxes,” Napolitano said. “But if we want things, we need the money to pay for them. You want more public safety, you want more firefighters, you want police officers, it costs money,” Napolitano said. “Roads. You want a pool, want wider sidewalks, it costs money. We can’t do it with the money we have. We’ve been going that route for many years, and we use the budget process on a yearly basis to try and backfill our needs, with an ever-aging infrastructure.”

The City has a long list of unfunded capital improvement projects, Napolitano said, including widened sidewalks for outdoor dining and a replacement for the increasingly dilapidated Begg Pool.

“We need new community centers,” Napolitano said. “Our community centers are decades old. People want wider sidewalks, they want to improve parks, they want to improve infrastructure, fill those potholes. Wishes and dreams don’t fund things. We need an ongoing revenue stream to pay for those things.”

Mayor Pro Tem Amy Howorth stressed that timing was of the essence. Local residents currently pay a total of 9.5 percent in sales tax, a combination of local and regionally-imposed taxes. LA County, which passed its own sales tax increase a few years ago, has a cap of 10.25 percent on how much the overall sales tax rate can be in any community. Howorth warned that the county could easily increase its portion of local sales tax yet again, and none of that money would go directly towards Manhattan Beach’s needs.

“It is hard to raise taxes. It’s not something I like to do,” Howorth said. “But it’s actually smart, because these funds will stay local … .But if we don’t determine that this is what we think we should do for the good of our community, then [the County] could go ahead and do it. So this is another form of local control.”

LA County, in fact, has already indicated it will seek to double the quarter cent sales tax voters approved under Measure H in 2017, revenue that is all earmarked to address homelessness. Hence the half cent increase the City is proposing would represent likely its last opportunity to raise the tax in a way that goes directly to local needs.

Councilperson Richard Montgomery referenced that staff report on the City’s sales tax, which currently accounts for 12 percent of City revenue. Sixty-one percent of sales tax revenues come not from residents, Montgomery said, but from visitors.

“Where’s it going to hit you? You go shopping, at the store, at a restaurant, CVS, Ralph’s – okay, yes, there, but look at what you get,” Montgomery said. “A hundred miles of roads, nine community centers, and we all know the Joslyn Center’s termites are holding up [with] their hands right now. It’s a matter of time. And 120 acres of parks. Who pays for that?

If you don’t pay now, you’re going to pay for it later.”

Montgomery made the motion to approve going forward with the ballot measure.

“Keep your money local,” he said. “Control it yourself, and look where it goes. That’s the main thing I would tell our residents. The half-cent would make a huge difference to us to keep it here, so I’d rather not look back at this time and say, ‘You should have raised the tax rate before the county, look what happened to us.’ This way, keep the money here and under our control, and take care of your own backyard.”

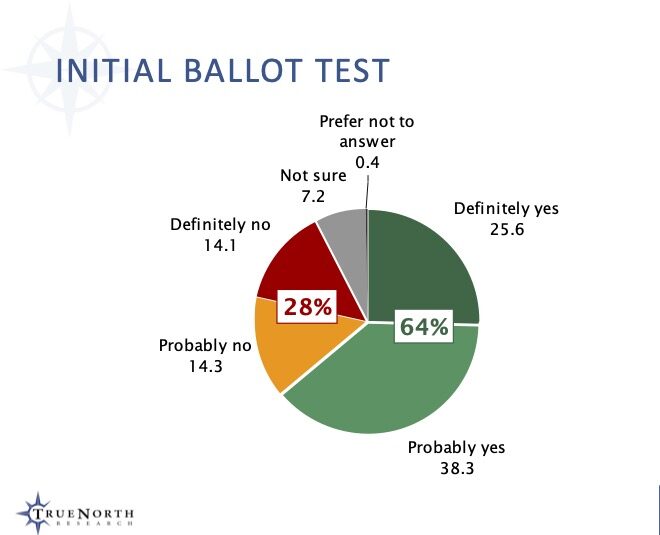

Timothy McLarney, the City’s polling consultant, gave the council the results of a survey recently conducted by his firm, TrueNorth. The survey found robust support for the sales tax increase, particularly when residents were made aware of specific projects and services for which the tax would provide revenue. Initial support was at 64 percent, which increased to 67 percent when residents were given specific local uses. Approval dropped to 58 percent when accompanied by negative arguments, McLarney said, such as the possibility that the City’s ballot measure would be one among other tax increases, including a school bond and a Beach Cities Health District bond, on the November ballot.

“Is it feasible if you as a Council were to choose to move forward with a November measure? Does it have a reasonable chance of success? The answer to that is clearly yes, based on these results,” McLarney said.

McLarney did sound a note of caution regarding the electoral climate in November.

“There are those kinds of elections that are what I call ‘feel good elections’ — things are going great, the economy’s going great, not a lot of controversy out there,” he said. “This is not going to be one of those elections, as you might imagine. We have a hyper partisan presidential contest that’s going to set the tone. We have some statewide initiatives that are probably going to create some headwinds for local measures, and you’re going have some overlapping measures that we already talked about. So again, I don’t think the obstacles are insurmountable, but I always believe that you should walk into an election cycle with your eyes wide open about what your potential challenges are.”

Mayor Joe Franklin said that prefers “good old fashioned” ballot measures that require two-thirds approval for tax increases. But he said the pros clearly outweigh the cons for this ballot measure and voted to approve it along with his colleagues.

“Let’s control our money,” he said. “Let’s control our destiny.”

Napolitano noted that the City has $200 million in capital improvements that it has been unable to fund.

“So there are so many reasons for this that outweigh the reasons against it,” Napolitano said. “I get it. I don’t like taxes. But the cost, as we saw explained – it’s $50 on $10,000 spent. Well, that’s money well-spent …This is a down payment on the future. This is about the projects that the city wants to do in the future. We stabilize our budgets. This is not about making payroll. This is about doing all those things that we haven’t been able to do, a $200 million wish list we have right now of capital improvements because we don’t have the money set aside. Now, if you want to do it with a drip, drip, drip of projects and improvements in the City where we scrape together a few dollars, do that. We do one project every ten years, okay. But if you want more than that – and I think the expectation of our community says that, and the polling shows that — then we need to do this. And what we need to do now is put that question out to the voters and let them decide.” ER