by Mark McDermott

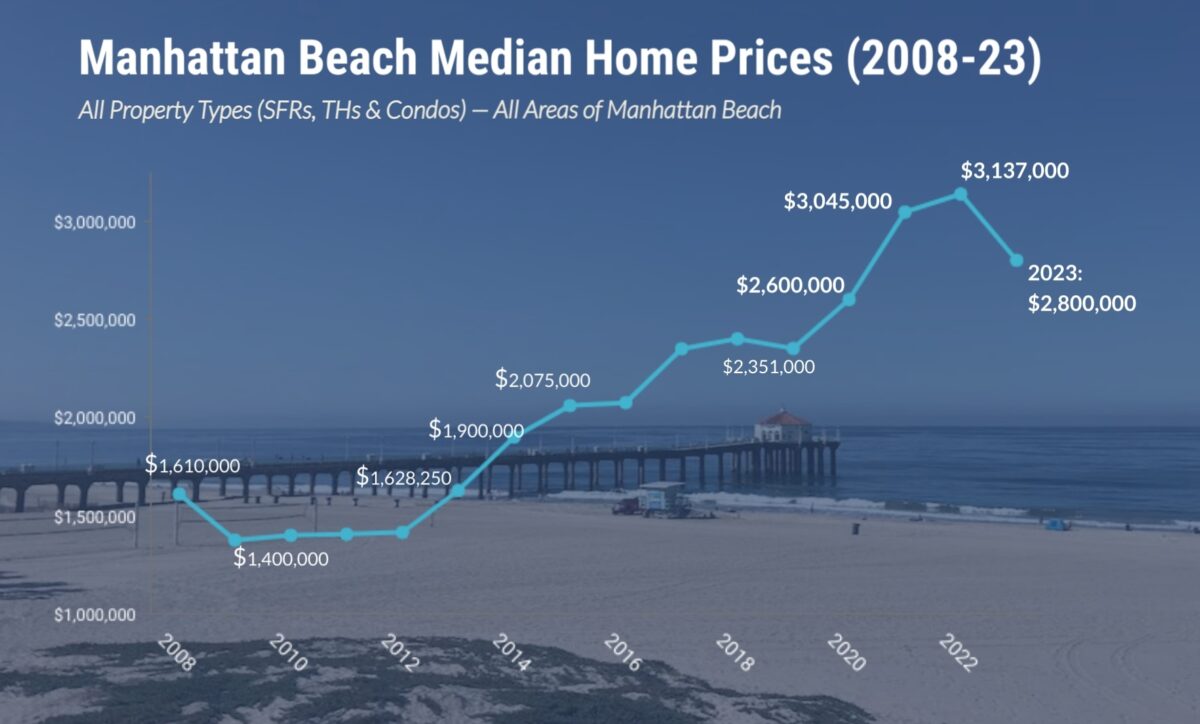

Manhattan Beach home sales sharply declined in 2023, dropping from 322 sales in 2022 to 253 last year, while median sale price also dropped from $3.1 to $2.8 million.

The decrease in sales, based on sales data reported to the Multiple Listing Service database, continues a precipitous two-year drop from 518 sales in 2022 and represented a 37 percent decline from the average of 393 sales per year since the beginning of the Great Recession in 2008. Last year’s sales were lower than the lowest year of the recession, 2008, in which 316 homes sold.

These numbers come from the annual data crunch conducted by Realtor Dave Fratello for his MB Confidential blog, in which he described 2023 as “one of the oddest years in two decades” in local real estate. It was a year that also included a record $12.8 million sale in the Tree Section and Strand Home unofficially hitting the market, via The Wall Street Journal, for $150 million.

Fratello, in an interview, said the reason for drop in overall sales is not hard to decipher.

“The simple answer is that changes in interest rates impacted both buyers and sellers, mainly by reducing the inspiration of potential sellers,” he said. “Because if you’re sitting on a 3% interest rate, and you’re looking at trading up to a beach house, you don’t like the idea that your rate is going to double or worse. Affordability, as such, was really hammered, and so people wanted to stick with their 3% mortgages. What that means is that by and large, the transactions that have been going on over the past year are primarily those that are life circumstances. Somebody died, somebody got divorced, somebody got a job transfer, but not a lot of movement by choice.”

The high and low ends of the local market were stable, Fratello said, with the decline occurring almost exclusively in the middle.

“It’s roughly the $4 million to $6 million range that is missing. That’s where the biggest dropoff is,” he said. “And that’s probably the main reason why the median price drops, too, because you have a fall off in sales at sort of a critical median here.”

The high end part of the Manhattan Beach real estate market has proven imperturbable for roughly the last 15 years. During the Great Recession, when most home sales were plummeting, new upper end price records were set in Manhattan Beach, such as a $16 million Strand home, which at the time was starkly above any previous sale.

“One of the things I remember from the post-Recession was that inherently valuable land along The Strand, the Hill Section, the highest-end markets — they were the first ones to start seeing eye-popping sales,” Fratello said. “And you had to look at yourself and say, ‘Well, what do these people know?’ Well, what they know is they are doing fine, and their outlook on the future is bullish. So it’s possible we are already seeing something analogous here.”

Among sales registered with the MLS, six Strand homes sold in 2023, ranging from $4.6 million to $14.5 million, while another sold off-market for $16.75 million. In November, 1000 The Strand went on the market for $30 million, which if sold would exceed the Manhattan Beach record, a $21 million home sold in 2017. But then later in November, the owner of the only triple lot house on The Strand, tech investor Rob DeSantis, announced through the Wall Street Journal that his home — which had already fetched $135,000 a month as a short-term rental — was for sale for $150 million.

“There are properties in Malibu that have sold for over $150 million, $200 million,” DeSantis told the WSJ, noting that his home had closer proximity to LAX and numerous restaurants than Malibu. “My personal opinion is, this house has everything those houses have to offer, and in some cases, more.”

If anything, the super luxury market in Manhattan Beach has spread beyond The Strand. LA Kings star Anze Kopitar’s double-lot walk street home, at 117 34th Street, went on the market for $37 million in September, while Detroit Lions quarterback Jared Goff spent $19 million to acquire two Hill section homes on which he presumably will tear down to build a larger mansion.

These are buyers and sellers, Fratello noted, to whom interest rates don’t particularly matter. Hence the high-end of the local market has continued to grow. Fratello said this part of the market is one of the few in the region that has not declined.

“I looked at the data for all kinds of Southern California markets and price points,” he said. “It shows that sales volume all over Southern California is down at about the same rate.,,,But the interesting thing when I look at Manhattan Beach data is that the high end really seems to be doing fine. Maybe that’s an indication that the very highest of the high-end buyers are people who are doing fine and aren’t particularly intimidated by prices and aren’t relying very much on financing, so it’s not as big of an impact on them to see the rates higher.”

Realtor Richard Haynes, who publishes a blog that analyzes the entire South Bay market, found that Manhattan Beach was not alone in seeing declines in overall home sales. His analysis showed that all three Beach Cities and every town on the Palos Verdes Peninsula except one — the gated community of Rolling Hills — experienced sales declines in 2023. While Manhattan Beach’s home sales were down 21.4%, Hermosa Beach’s were down 25.3% and Redondo Beach 14.7%. In PV, Palos Verdes Estates was down 11.7%, Rancho Palos Verdes 22.4%, and Rolling Hills estates 33.6%. But in Rolling Hills, a trend that began during the pandemic — when sales in the gated community increased by 50 percent — resumed with a 27.8 increase (albeit with small numbers, a total of only 33 sales).

Haynes said interest rates going from historic lows a few years ago to historical highs this year were the driving factor for the overall decline in sales.

“It’s really the lack of inventory,” he said. “Unfortunately, people have their golden handcuffs, and there are just fewer homes on the market — the golden handcuffs of low interest rates enjoyed by everyone who purchased a couple years ago, or who refinanced during COVID. So you’ve got fewer people willing to sell. If you look at the data, Manhattan Beach, Hermosa Beach, most of Redondo Beach and all of the PV Hill are either at all time historic lows of homes for sale or incredibly close, like the second or third lowest time ever for homes for sale.”

Haynes likewise found median price declines in most of the cities he analyzed. Manhattan Beach’s 10.7% was the biggest decline, followed by an 8.4% decline in Palos Verdes Estates (from $2.8 million to $2.565,500 million), 4.3 percent in Rancho Palos Verdes ($1.75 million down to $1.675 million), and Redondo Beach down 3.3% (from $1,450,000 million to $1,402,500 million). Hermosa Beach, which Haynes calls “Mr. Dependable” for its slow but steady increases before, during, and since the pandemic, grew 2.3% in from a median price of $2,150,000 in 2022 to $2,200,000 in 2023. Rolling Hills Estates grew 3.3%, from $1,649,000 to $1,700,000, while Rolling Hills increased a whopping 25.3%, from $3,575,00 to $4,480,000.

The backdrop to the sales declines is the fact that the Federal Reserve hiked its interest rates 11 times since March of 2022. The result was mortgage rates hit a 20-year high 8% in 2023, following a decade of record lows. The real estate company Redfin issued a report that called 2023 “the least affordable year for home buying on record.”

Haynes largely agreed with this assessment.

“Affordability is essentially the lowest it’s ever been, outside the lead up to the Great Recession and obviously that big real estate bubble bursting in 2008,” he said. “So you have this squeeze of inventory of historic proportions, and affordability that is essentially the second-lowest in history, and buyers can’t afford to actually buy the homes on the market. That is why sales have plummeted, and 2022 was even worse. You saw 40% and 50% drops in 2022, and you are seeing even further drops in 2023 because inventory has gotten even less and affordability has continued to get worse.”

Haynes said that affordability can be a somewhat different issue in the local market than it is in most other places.

“In California, just to afford a median priced home, which is the high eight hundreds or $900,000, you need to make $200,000 with 20% down,” Haynes said. “And so, if you take that median price in Manhattan Beach approaching $3 million, in theory you need to make a half a million dollars or more if you are putting 20% down. Now, that’s not the case, because I sold three homes in Manhattan Beach of very expensive proportions — one was $4.75 million, another at $7.77 million, and another at $4.75 million — and all three of my buyers were cash. So, you know, you are not seeing a lot of people buying $5 million homes and just putting 20% down. Many are trading their homes and have significant equity, or maybe they sold their company. Maybe they are a highly paid professional, a doctor, a lawyer, an athlete, and putting down big bucks. So, in a way, affordability gets thrown out the window in areas like Manhattan Beach and behind the gates in Rolling Hills or Palos Verdes Estates, because buyers aren’t taking on $4 million mortgages and just putting down a million dollars.”

Affordability is an entirely different equation in the rest of the U.S. According to the National Association of Realtors, nationwide, the median price for an existing home is $387,600, a bit over a third of California’s median price, or about 14 percent of the median price of a Manhattan Beach home.

In any case, the Federal Reserve has indicated it is done increasing interest rates, and mortgage rates have already dropped. Haynes believes the South Bay “weathered the storm” of the past two years and could see a rebound in 2024.

Fratello said that in the long run, Manhattan Beach’s prospects remain almost unalterably upward. An example, from 2023, was a new price record that was set for Rosecrans Avenue by a spec home sale. The previous high on Rosecrans, due to its being a traffic thoroughfare, was $2.3 million, and so it raised eyebrows when the home went on the market in August for $4.995 million. Fratello, in his blog, called it “The Biggest Bet Yet on Rosecrans.” The price dropped to $4.1 million in October, then, at the turn of the year, closed at $3.9 million — not what was originally asked for, but $1.6 million more than the previous high. The lot, Fratello noted, was purchased for $1.25 million in 2020. Another speculative transaction occurred when a buyer in 2021 paid $3.35 million for a double-sized lot on Maple Avenue in the Tree Section, and went against conventional wisdom — breaking it in two for a quick, low risk profit — and instead built a 6,137 sq. ft. house, which was only on the market 11 days when it sold for $7 million (which was not even a record high for the Tree Section this year, Fratello noted, as a home at 604 14th Street sold for $10.775 million). Haynes wrote about another former spec house, a walk street house at 221 19th Street, that was built in 2019 and sold for $9.7 million in early 2020. Last August, the home’s off-market sale set what Haynes believed was a record for a single, standard 30 ft. by 90 ft. lot, at $12.8 million.

The moral of the tale, Fratello said, is don’t wager against Manhattan Beach when it comes to real estate.

“Everybody who bets against prices in Manhattan Beach loses pretty quickly,” Fratello said. “But it’s interesting. Objectively, we had a 10% drop in the median price in the course of a year. We had low sales volume. I mean, you could construct a case either way. I mean, does it matter how many or how few sales there are? It’s basically realtors and lenders who had a terrible year, but I am not sure the average Manhattan Beach resident gives a crack, because these are not really indications that the market is unhealthy, that it’s a bad time to sell or a bad time to buy. It’s just people reacting to affordability, and when people adjust, they’ll go, ‘Okay, I guess that’s the new reality,’ and they’ll probably resume more normal activity…It just feels like people sat the year out and they are ready to go. Proof is in the data, but I wouldn’t bet against prices recovering. This is Manhattan Beach.”

See MBConfidential.com and HaynesRE.com/blog for more information. ER